4. "Full Market Awareness" A professional relations company and consulting firm Disclaimer Notice: The information contained in this e-mail message and its attachments is intended solely for the use of the individual(s) to whom it is addressed and may contain information that is the confidential information of Acorn Management Partners L.L.C. ("AMP") and its subsidiaries. The Information may be about companies in which A.M.P has or may receive compensation in the future. Any material in this message should be considered as ADVERTISEMENT ONLY. Please consult with a certified financial advisor before making any investment decisions. All information on this report should be confirmed before making an investment decision. Acorn Management Partners L.L.C. ("AMP") and its subsidiaries, and any affiliates and information providers make no implied or express warranties on the information provided. This is not to be construed as a solicitation to buy or sell securities. As with any stock, the featured companies involve a high degree of risk and volatility, and all investors/advisors should know that they may lose a portion or all of their investment if they decide to purchase any stock. Acorn Management Partners L.L.C. ("AMP"), its affiliates, associates, relatives and anyone associated with in any manner reserves the right to either buy or sell shares in the profiled company's stock. The Securities and Exchange Commission has compiled an extensive amount of information concerning investing, including the inherent risks involved. We encourage our readers to visit the SEC's website to acquire this important information. Safe Harbor Disclosure: Acorn Management Partners L.L.C. ("AMP") website publications may contain or incorporate by reference "forward- looking statements, including certain information with respect to plans and strategies of the featured company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward- looking statements. Without limiting the forgoing, the words "believe(s)," "anticipate(s)," "plan(s)," "expect(s)," "project(s)" and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause actual events or actual results of the Companies profiled herein to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business and financing, business trends, future operating revenues and expenses. Although the Company believes that the statements are reasonable, it can give no assurances that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in any and/or all profile/ research reports, contain no guarantee of future performance, and that the actual result may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various fa ctors including, but not limited to, the Company's ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. Any statements that express or involve discussions with respect to predictions, expectat ions, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be "forward looking statements." Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking stat ements in this action may be identified through the use of words such as "expects," "will," "anticipates," "estimates," "believes," "may," or by statements indicating certain actions "may," "could," or "might" occur. We encourage our readers to invest carefully and review all forms of investments and read the investor information. More information please visit http:// www.sec.gov and/or (FINRA) at: http://www.FINRA.com. Readers can review all public filings by compan ies at the SEC's EDGAR page. The FINRA has published information on how to invest carefully at its websi te.

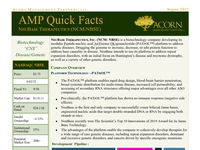

2. Continue Reading for: Recent News, Market Size, Management Background & Our Disclosure... 1. Establish GNRS retail footprint in Connecticut and Arizona through organic build out or acquisition 2. Evaluate new markets, especially in contiguous states 3. Investigate branded product leaders with multi-state presence Market Highlights: Arizona • Proposition 207 to legalize REC passed in November 2020, and adult-use sales commenced in late January 2021 • Over $1.2 billion in combined medical and recreational sales reported for 2021 • Estimated 2022 market size of $1.6 billion • 169 retail licenses available statewide • 143 cultivation licenses available statewide The Greenrose Holding C ompany Inc. currently consists of two, cultivation-focused operating businesses: • Theraplant in Connecticut • True Harvest in Arizona Expansion Strategy: Market Highlights: Connecticut • CT Governor recently confirmed EOY Rec launch • Social equity cultivation licenses issued • Currently a limited license medical market, with upcoming limited license adult-use market projected to begin in the second half of 2022 o $200 million in medical sales in 2021 o Adult-use sales projected to grow from $250 million in its first full year to $750 million in its fourth year • 18 medical dispensaries today; maximum number of additional dispensaries licenses to be determined • 12 additional recreational store licenses will be awarded in 2022 • C urrent cultivators will have the opportunity to open up an unlimited number of recreational stores as a minority partner in a social equity license

3. Continue Reading for Management Background & Our Disclosure... Management Team: Mickey Harley CEO • Formed The National Pecan Company, the largest, vertically-integrated pecan company in the world. Acquired by Diamond Foods 2017. • VP , Director Management and I nvestment S trategies for Allen & Company. Paul Otto Wimer President • Customer focused entrepreneur and innovation leader. • Architect of long-term strategy and core business partnerships. • Led Innovation, Strategy Development, and and corporate venture capital exploration for several health & wellness clients. Bernard Wang CFO • Over 25 years of deep finance and accounting experience with public and private companies • Highly skilled in improving internal controls, accounting processes, and capital raising initiatives. • Key category background including Cannabis with Canndescent, a CA-based luxury cannabis flower company Daniel Harley EVP, Investor Relations • Over 30 years of investment experience in both U.S. and internationally • Founder of global event driven fund investing in distressed companies, special situations and warrant arbitrage. Recent News: • Announced new CFO, Bernard Wang and board member, Benjamin Rose. • The Greenrose Holding Company First Quarter 2022 Results May 16, 2022 Highlights: Focus on Optimizing Inventory in Connecticut and Production Capacity in Arizona Improving Positioning for Early-Stage Recreational Market Opportunities Provides Revised Guidance for the Full Year Ended December 31, 2022 • The Greenrose Holding Company presented at 3 conferences and will continue to select additional conferences throughout the Fall. • Viridian Capital Advisors Reports on The Greenrose Holding Company • The Greenrose Holding Company Closes Asset Purchase of True Harvest • Greenrose Acquisition Corp. Announces Closing of Business Combination w/Theraplant • Greenrose Acquisition Corp. Stockholders Approve Business Combination • 20+ year career in cannabis • Founder & CEO, Theraplant Dan Emmans East Region President Operating Subsidiaries:

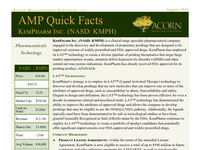

1. AMP Quick Facts The Greenrose Holding Company Inc (OTCQX: GNRS) Acorn Management Partners, LLC August 2022 OTCQX: GNRS Price: $ 2. 80 Date: 0 8 / 04 /2022 Fiscal Year: 12/31 MKT Cap: ~ $ 49 . 24 m C.O.H . : ~ $ 3 . 34 m ~ 1 8 . 57 % Inside Ownership: ~ 30.09 % S/O: ~ 17.59 m Float: ~ 12 .71 m AVG Vol.: ~ 2.75 k For More Information Please Email : Vic tor Rios vrios@acornmanagement partners.com Industry: "Cann a b i s Industry" Continue Reading for: More Information, Recent News, Management Background & Our Disclosure... The Greenrose Holding Company Inc. (GNRS) is a multi-state grower and producer of cannabis brands and products. Greenrose is driven by cultivation. The Company understands that to be a leader in cannabis, it starts w ith outstanding products from sophisticated genetics and unique growth methods. The scientific focus is on superior plant and strain development. The brands offer a wide variety of products to the consumer. Operational Efficiency: The company is currently operational in established markets, but expects to target newer cannabis markets. The Company's goal is to vertically integrate in the markets where it already operates, while exploring new, contiguous, markets. Greenrose is run by talented institutional management, who expect to drive profitability and positive cash flow . Its vision is to be synonymous with extraordinary cannabis products. Great flower is in our DNA. The Greenrose Vision "Greenrose aims to be synonymous with extraordinary cannabis products and services. (They) are cultivation-led, aiming to deliver top-quality flower at every price point." • • Theraplant: Top quality flower in CT Shango : brand now u nder license by Greenrose in AZ captured #1 or #2 in 2021 Arizona Cannabis Cup for flower and solvent-less extract categories The Greenrose platform has two strong brands: Institutional Ownership: